How to Make Your Salary Last Longer: Budget Hacks to Beat Rising Costs

ayaan | Aug 30, 2025, 14:33 IST

Indian money

( Image credit : Unsplash )

Managing money smartly is key to a secure future, especially in 2025 when expenses seem to rise and uncertainties linger. This article offers simple financial life hacks focused on budgeting and saving to help anyone take control of their finances. Learn easy ways to budget your income, cut costs, save regularly, and grow your financial stability with habits that anyone can follow.

In 2025, managing your money with smart budgeting and saving habits is essential for financial peace and growth. This article shares easy to follow life hacks that help you create a clear budget, control your spending, automate your finances, and build multiple income sources. Whether you're just starting or want to improve your money management, these practical tips will guide you toward a stronger financial future.

1. Building a Clear and Practical Budget

Budgeting is the foundation of good financial health. Start by tracking all your income and monthly expenses, including fixed costs like rent and utilities, and variable costs such as groceries and entertainment. Use budgeting apps or simply write it down to see where your money goes. A clear budget helps you avoid unnecessary spending and find opportunities to save.

2. Pay Yourself First

One of the most effective financial habits is to pay yourself first. Set aside a portion of your income for savings before spending on anything else. This ensures that saving becomes a priority, helping you build an emergency fund or save for big goals like a house or education. Automate this process by scheduling regular transfers to your savings account to stay consistent with little effort.

3. Control Spending and Avoid Impulse Purchases

Small, regular expenses can drain your finances without you noticing. Cut back on daily treats like takeout coffee or frequent online shopping by planning meals at home and unsubscribing from marketing emails. Create a "wants list" to pause and review your purchases, helping you identify whether you really need something before buying.

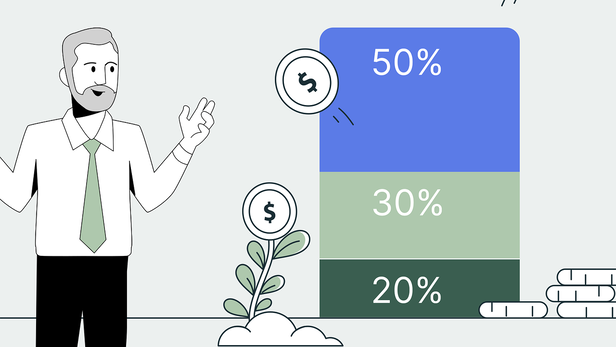

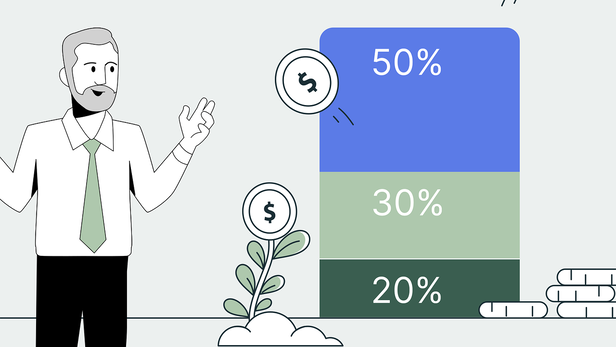

4. Use the 50/30/20 Rule for Balanced Finances

This simple rule divides your income into three parts: 50% for essentials (needs), 30% for lifestyle choices (wants), and 20% for savings or paying off debt. It helps keep your spending balanced while prioritizing financial security. Adjust the percentages based on your personal situation but use it as a guide to avoid overspending in one area.

5. Automate Your Finances for Consistency

Automation helps reduce stress and late fees by setting up automatic payments for bills like rent, utilities, and credit cards. Likewise, automate your savings to move money from your checking account to a savings or investment account regularly. This "set it and forget it" approach ensures you don’t miss payments or scrambling to save at the last minute.

6. Build Multiple Income Streams

In addition to managing expenses, increasing income can greatly boost your financial security. Explore side jobs, freelancing, rental income, or investment dividends. Even a small additional income monthly can speed up debt repayment and help save for your goals faster, reducing financial worries over time.

7. Track and Adjust Your Progress

Regularly review your budget, expenses, and savings to make sure you are on track. Use monthly or quarterly check-ins to adjust your spending, increase savings, or find new ways to optimize your finances. Keeping yourself accountable through simple tracking improves discipline and shows tangible progress.

Financial freedom is something anyone can achieve by managing money wisely. Start by making a clear budget and always save a part of your income first. Keep an eye on your spending and avoid unnecessary costs. Let technology help by automating your savings and bill payments. Also, try to find extra ways to earn money. The secret is to be consistent and make small improvements every day. Begin with these simple money tips now, and you’ll feel more confident and worry-free about your finances in the future. "Small habits today build a secure and stress-free financial future."

Explore the latest trends and tips in Health & Fitness, Spiritual, Travel, Life Hacks, Trending, Fashion & Beauty, and Relationships at Times Life!

1. Building a Clear and Practical Budget

Budget

( Image credit : Pixabay )

Budgeting is the foundation of good financial health. Start by tracking all your income and monthly expenses, including fixed costs like rent and utilities, and variable costs such as groceries and entertainment. Use budgeting apps or simply write it down to see where your money goes. A clear budget helps you avoid unnecessary spending and find opportunities to save.

2. Pay Yourself First

Prioritize Yourself

( Image credit : Pixabay )

One of the most effective financial habits is to pay yourself first. Set aside a portion of your income for savings before spending on anything else. This ensures that saving becomes a priority, helping you build an emergency fund or save for big goals like a house or education. Automate this process by scheduling regular transfers to your savings account to stay consistent with little effort.

3. Control Spending and Avoid Impulse Purchases

Impulse Purchases

( Image credit : Pixabay )

Small, regular expenses can drain your finances without you noticing. Cut back on daily treats like takeout coffee or frequent online shopping by planning meals at home and unsubscribing from marketing emails. Create a "wants list" to pause and review your purchases, helping you identify whether you really need something before buying.

4. Use the 50/30/20 Rule for Balanced Finances

50/30/20 Rule

( Image credit : Pixabay )

This simple rule divides your income into three parts: 50% for essentials (needs), 30% for lifestyle choices (wants), and 20% for savings or paying off debt. It helps keep your spending balanced while prioritizing financial security. Adjust the percentages based on your personal situation but use it as a guide to avoid overspending in one area.

5. Automate Your Finances for Consistency

Time Management

( Image credit : Pixabay )

Automation helps reduce stress and late fees by setting up automatic payments for bills like rent, utilities, and credit cards. Likewise, automate your savings to move money from your checking account to a savings or investment account regularly. This "set it and forget it" approach ensures you don’t miss payments or scrambling to save at the last minute.

6. Build Multiple Income Streams

Growth

( Image credit : Pixabay )

In addition to managing expenses, increasing income can greatly boost your financial security. Explore side jobs, freelancing, rental income, or investment dividends. Even a small additional income monthly can speed up debt repayment and help save for your goals faster, reducing financial worries over time.

7. Track and Adjust Your Progress

Tracking Progress

( Image credit : Pixabay )

Regularly review your budget, expenses, and savings to make sure you are on track. Use monthly or quarterly check-ins to adjust your spending, increase savings, or find new ways to optimize your finances. Keeping yourself accountable through simple tracking improves discipline and shows tangible progress.

To Wrap Up

Explore the latest trends and tips in Health & Fitness, Spiritual, Travel, Life Hacks, Trending, Fashion & Beauty, and Relationships at Times Life!

Frequently Asked Questions (FAQs)

- What are the best budgeting tips for 2025?

Use the 50/30/20 rule to divide your income: 50% needs, 30% wants, 20% savings. Track all expenses regularly. - How can I start saving money effectively?

Pay yourself first by automatically transferring a fixed amount to savings each month. - What is the 50/30/20 budgeting rule?

It splits your income into essentials, wants, and savings to help balance spending. - How can automation help in saving?

Automating savings and bill payments ensures consistency and avoids late fees or missed goals. - What apps are best for budgeting in 2025?

Apps like Mint, YNAB, and PocketGuard make tracking spending simple and effective. - How can I avoid common budgeting mistakes?

Regularly review your budget, avoid unplanned expenses, and don’t neglect savings.