From Parity to ₹86: Tracing the Indian Rupee’s Journey (1947–2025)

Nidhi | Jan 25, 2025, 22:27 IST

Explore the fascinating journey of the Indian rupee from its parity with the U.S. dollar in 1947 to its depreciation to ₹86 in 2025. This article delves into the key economic events, policies, and global factors that shaped the rupee's value, including major devaluations, the 1991 economic liberalization, and the impact of global crises like the 2008 financial meltdown and the COVID-19 pandemic. It also highlights the role of Indo-U.S. relations and structural challenges like trade deficits and inflation in influencing the rupee's journey.

z"Did you know that in 1947, ₹3.30 could buy you 1 U.S. dollar? Fast forward to 2025, and it takes approximately ₹86 to make the same exchange. This dramatic shift in value is not just about numbers—it’s a reflection of India’s economic journey, shaped by wars, reforms, global crises, and evolving Indo-U.S. relations. What caused this transformation? What stories do these figures tell about a nation finding its place on the global stage?" The Indian rupee has witnessed a rollercoaster journey, from the confidence of a newly independent nation to the challenges of globalization. This article unpacks the key events, policies, and structural factors that influenced the rupee’s trajectory, shedding light on its highs, lows, and the road ahead.

The Indian rupee has witnessed a rollercoaster journey, from the confidence of a newly independent nation to the challenges of globalization. This article unpacks the key events, policies, and structural factors that influenced the rupee’s trajectory, shedding light on its highs, lows, and the road ahead.

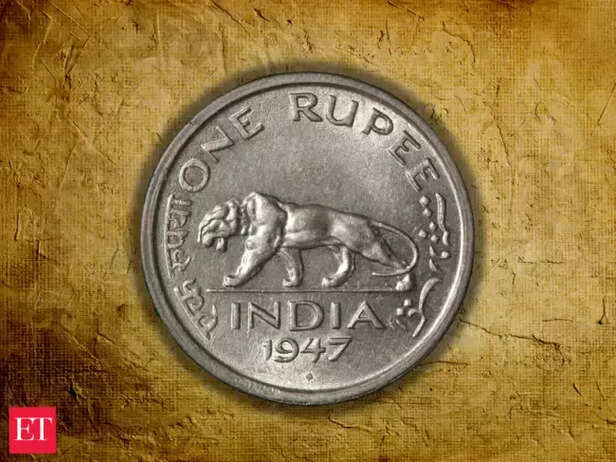

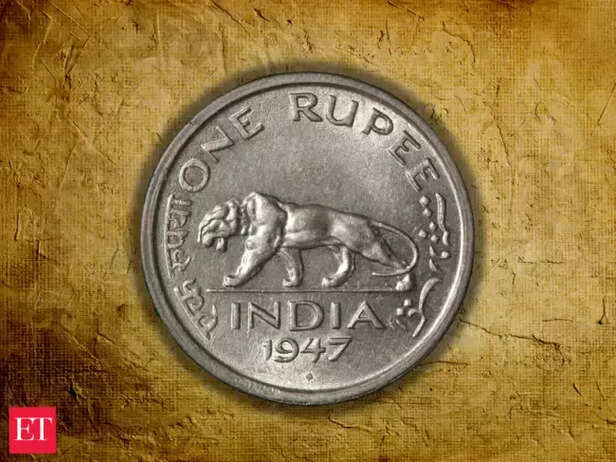

In 1947, the Indian rupee was pegged to the British pound, making ₹4.16 equivalent to one U.S. dollar. The newly independent nation adopted socialist-inspired policies to rebuild its economy.

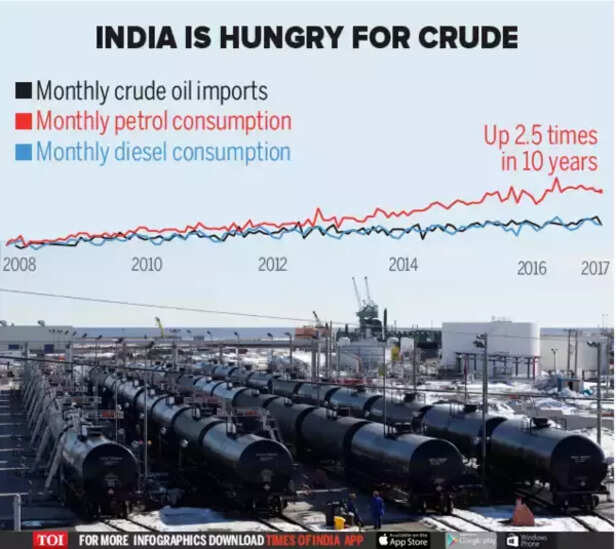

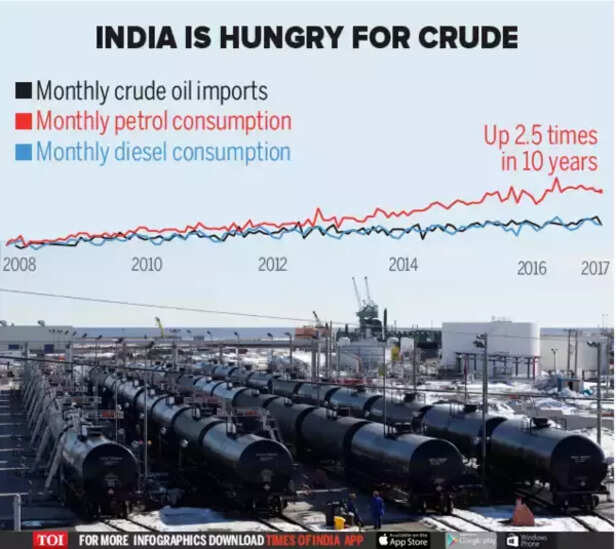

India consistently imports more than it exports, especially crude oil, electronics, and technology, creating trade deficits. These deficits increase demand for foreign currency, putting downward pressure on the rupee.

India’s inflation rates have historically been higher than those of developed countries like the U.S., eroding the rupee’s purchasing power and affecting its global value.

The rupee is highly sensitive to capital flows. During times of global uncertainty, investors often pull out funds from emerging markets like India, leading to rupee depreciation.

The crisis caused capital outflows and reduced investor confidence. The rupee depreciated to ₹48.82 by 2009 as foreign funds exited Indian markets.

The pandemic severely disrupted global supply chains and domestic economic activity, leading to increased government borrowing and capital outflows. These factors further weakened the rupee.

The pandemic severely disrupted global supply chains and domestic economic activity, leading to increased government borrowing and capital outflows. These factors further weakened the rupee.

The Reserve Bank of India (RBI) has adopted managed floating exchange rate policies, frequently intervening in forex markets to stabilize the rupee. Despite its efforts, external factors often overpower domestic interventions.

To mitigate the rupee’s decline, India must:

The Indian rupee’s journey from parity with the U.S. dollar to ₹86 reflects the challenges and resilience of the Indian economy. While global factors have played a significant role, domestic policies and structural reforms will be crucial in shaping the rupee’s future. Understanding this journey provides valuable insights into India’s economic evolution and its place in the global economy.

Indian Rupee Note

Historical Context: Post-Independence Era

History of Indian Rupee

In 1947, the Indian rupee was pegged to the British pound, making ₹4.16 equivalent to one U.S. dollar. The newly independent nation adopted socialist-inspired policies to rebuild its economy.

- Partition Impact: The partition disrupted trade routes and industrial centers, creating economic instability.

- Import Substitution: Policies aimed at self-reliance led to inefficiencies, stifling India’s global competitiveness.

- Fixed Exchange Rate: The rupee’s value was pegged, ensuring stability but leaving it vulnerable to external shocks.

Major Events and Policies

1966: The First Major Devaluation

- Context: Wars with China (1962) and Pakistan (1965) strained resources. Consecutive droughts worsened the economic crisis.

- Action: The rupee was devalued by 57%, from ₹4.76 to ₹7.50 per dollar, to boost exports and stabilize the balance of payments.

- Result: The move led to inflation and public dissatisfaction, with limited export growth.

Economic Crisis 1991

1991: Economic Liberalization

- Crisis Point: Facing a balance of payments crisis, India had foreign reserves for only a few weeks of imports.

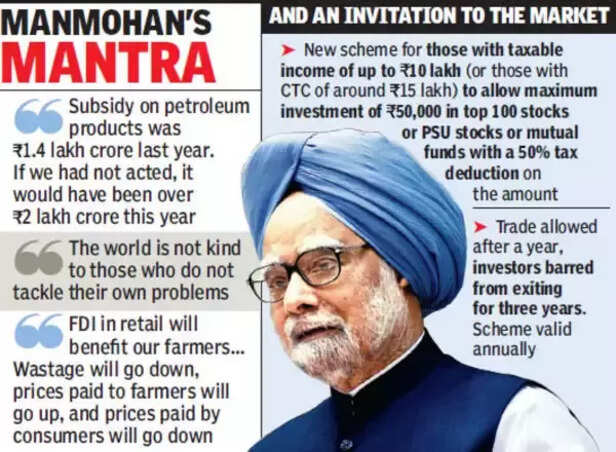

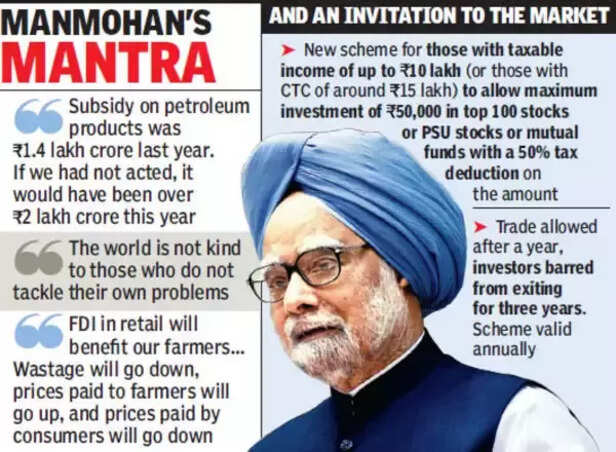

- Reforms: Prime Minister P.V. Narasimha Rao and Finance Minister Dr. Manmohan Singh introduced market-oriented reforms, including rupee devaluation to ₹25 per dollar, trade liberalization, and encouraging foreign investment.

- Impact: The reforms stabilized the economy but exposed the rupee to global market volatilities.

Indian Rupee during Independence

1992–2000: Transition to Market-Determined Exchange Rates

- Shift: India adopted a market-determined exchange rate system in 1992.

- Volatility: External factors like the 1997 Asian financial crisis and rising import demand led to the rupee’s depreciation to ₹44.31 by 2000.

Structural Factors Affecting the Rupee

Trade Deficits

Inflation

Capital Flows

2000–2020: Economic Growth and Global Shocks

2008 Global Financial Crisis

Demonetization

Policy Shifts

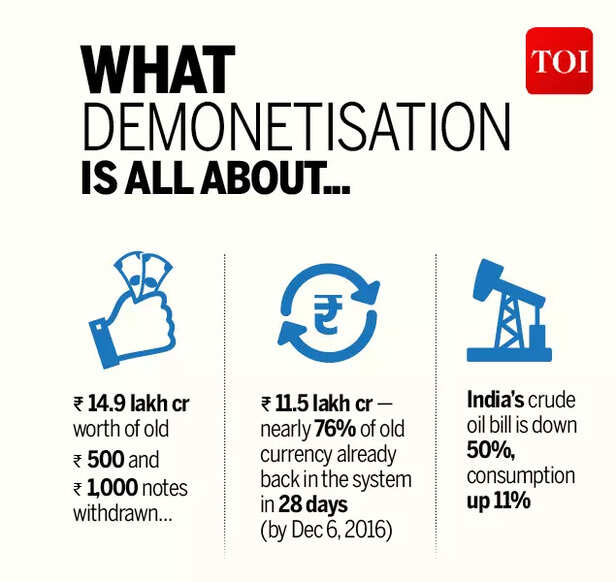

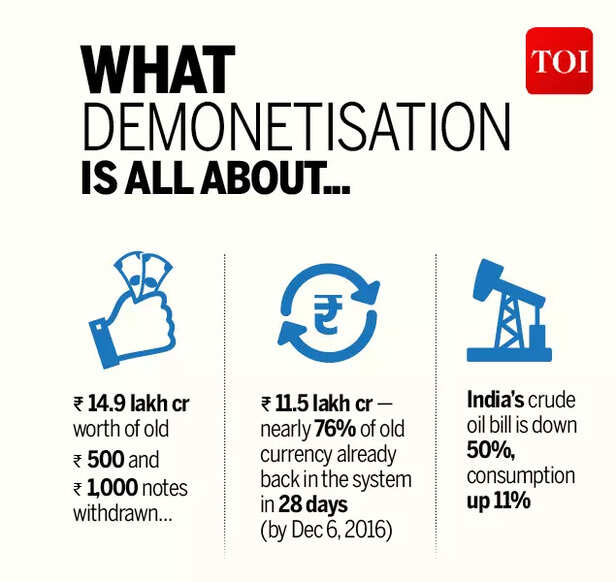

- Demonetization (2016): The government invalidated ₹500 and ₹1,000 notes to combat black money. While the move disrupted economic activity temporarily, it had minimal long-term impact on the rupee.

- Goods and Services Tax (GST) (2017): GST aimed to unify India’s tax system. Initial challenges impacted economic growth and investor sentiment.

2021–2025: Recent Developments and Indo-U.S. Relations

COVID-19 Pandemic

Covid and Indian Rupee

RBI Policies

Indo-U.S. Relations

- Trade Agreements: Strengthened ties with the U.S. have influenced the rupee, with trade agreements boosting investments but also increasing reliance on imports.

- Global Economic Policies: U.S. tariff adjustments and interest rate hikes have caused capital outflows from emerging markets like India, affecting the rupee’s value.

Key Events Leading to Sudden Fluctuations

- 1973 and 1979 Oil Shocks: c led to surging import bills and significant rupee depreciation.

- 1997 Asian Financial Crisis: This regional turmoil caused investor panic, leading to rupee volatility.

- 2008 Global Financial Crisis: The crisis triggered capital flight to safer assets, weakening the rupee.

- 2013 Taper Tantrum: U.S. Federal Reserve’s announcement of tapering bond purchases caused capital outflows, pushing the rupee to an all-time low of ₹68.85.

- 2022 Energy Crisis: Russia-Ukraine tensions led to soaring crude oil prices, increasing India’s trade deficit and pressuring the rupee.

The Road Ahead: Strengthening the Rupee

Crude Oil Price

- Enhance Export Competitiveness: Invest in technology, infrastructure, and manufacturing to reduce trade deficits.

- Diversify Energy Sources: Shift to renewable energy to reduce dependence on imported oil.

- Attract Stable Investments: Focus on long-term FDI instead of volatile portfolio inflows.